The Jewish Foundation is

Your Partner in Planning

The Jewish Foundation is your trusted and expert resource for charitable gift planning and endowments, and serves as your partner and resource for synagogues, local Jewish agencies, professional advisors and donors.

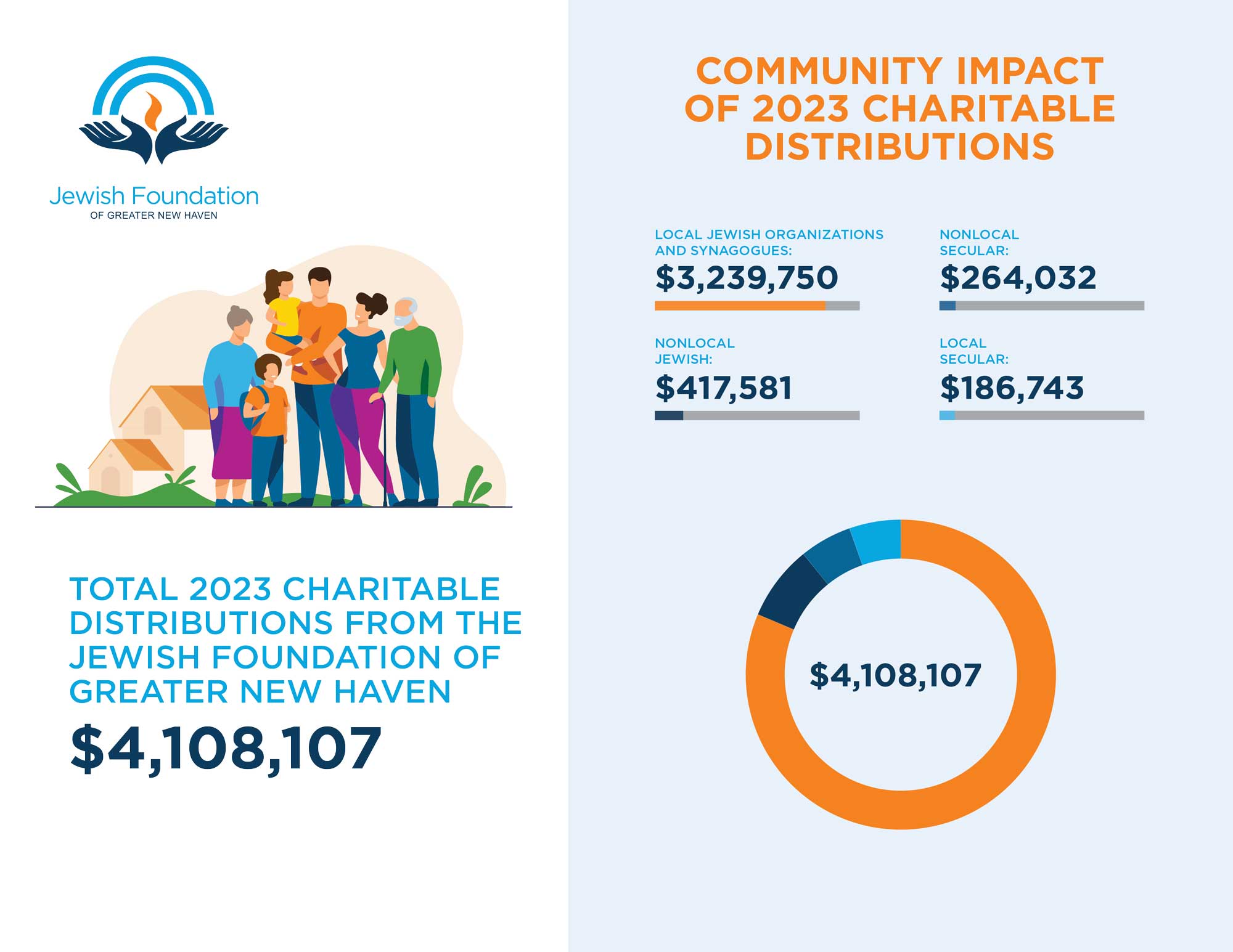

In 2022, the Jewish Foundation of Greater New Haven distributed over $3.9 million to charitable organizations, of which, 82% was distributed to local Jewish organizations.

The Jewish Foundation solicits and cultivates new endowment funds and planned gifts for the Jewish Federation, local Jewish agencies and synagogues

Tell Me More

The Jewish Foundation provides scholarships to Jewish overnight camps, summer and gap year programs in Israel, colleges, as well as for religious school at our local synagogues

Tell Me More: Grants

Tell Me More: Scholarships

COMMUNITY WISH LIST 2023

Make Your Community’s Wishes a Reality

Build a strong Jewish Future for the Next Generation

“Act while you can; while you have the chance, the means, and the strength.” —Talmud

Create a Jewish Legacy is a collaborative endowment program that benefits New Haven’s Jewish agencies and synagogues. This program is funded by the Jewish Foundation of Greater New Haven and the Harold Grinspoon Foundation of Western Massachusetts. It is designed to enable donors to fulfill their philanthropic goals while strengthening New Haven’s Jewish community, now and in the future. Create a Jewish Legacy will help sustain vital programs, services and institutions that assist the vulnerable and advance Jewish life in New Haven, in Israel and around the world.

Types of Funds

With over 700 funds, The Jewish Foundation of Greater New Haven can help you explore any number of charitable opportunities that will work for you and your family.

There are many different ways in which you can establish an endowment fund for what is important to you. Below are some of the types of funds you can establish through a current gift, a bequest, a gift of insurance or retirement assets.

DESIGNATED/ RESTRICTED FUNDS

FOR SYNAGOGUES, AGENCIES AND OTHER ORGANIZATIONS

PACE & LOJE

PERPETUAL ANNUAL CAMPAIGN ENDOWMENT AND (LION OF JUDAH ENDOWMENT

DONOR ADVISED

PHILANTHROPIC FUNDS

YOUTH PHILANTHROPY

BUILD A TZEDAKAH FUNDS

FUND MANAGEMENT

AND INVESTMENT OF SYNAGOGUE, AGENCY AND ORGANIZATION CUSTODIAL ACCOUNTS

UNRESTRICTED FUNDS

Unrestricted Funds allow the Foundation to meet the changing needs of the Jewish community through our grants process, the planning and allocations process of the Jewish Federation, and community initiatives. Many community members have established such funds in honor of a special anniversary or birthday, or in memory of a loved one.

FUNDS FOR JEWISH EDUCATION

You can establish a fund or add to an existing fund for Jewish education. Your fund can be for your scholarships to synagogue schools, Jewish day schools or pre-schools or for March of the Living. You can also add to an existing fund or establish a fund for Jewish special education or for the many programs sponsored through the Center for Jewish Life and Learning.

FUNDS FOR SYNAGOGUES

You can establish a restricted endowment fund at the Jewish Foundation for the benefit of your synagogue. Your fund can be designated for specific purposes such as religious school scholarships, adult education or to subsidize membership for those in need, or it can be for general purposes. Your fund can be named after loved ones or in honor of a special occasion. Every year your synagogue will receive a distribution from your fund.

FUNDS FOR JEWISH CAMPING

You can establish a restricted endowment fund at the Jewish Foundation for the benefit of Camp Laurelwood or the JCC Camp. Your fund can be designated for specific purposes such as scholarships or it can be for general purposes. Your fund can be named after loved ones or in honor of a special occasion. Every year your synagogue will receive a distribution from your fund.

FUNDS FOR LOCAL JEWISH AGENCIES

You can establish a restricted endowment fund at the Jewish Foundation for the benefit of the Towers, the JCC, UCONN Hillel, the Jewish Cemetery Association, Jewish Family Service, the Jewish Historical Society, or for any program or organization that is important to you. Your fund can be designated for specific purposes or it can be for general purposes. Your fund can be named after loved ones or in honor of a special occasion. Every year the organization will receive a distribution from your fund.

ISRAEL AND OVERSEAS ENDOWMENT FUNDS

The Jewish Foundation holds restricted endowment funds that guarantee that our community will continue to support Israel and Jewish communities in need overseas. These funds make annual distributions for the Jewish Agency for Israel, the American Joint Distribution Committee, or to donor designated charitable Jewish organizations which support Israel and Jews in need overseas. You can donate to the Israel Endowment Fund at the Jewish Foundation, or, establish your own family endowment fund to support Israel and Jewish communities in need overseas.

FUNDS FOR WOMEN'S PHILANTHROPY

Women of Vision 2022 Grant recipients

Women of Vision 2022 brochure

FUNDS IN MEMORY OF OR IN HONOR OF LOVED ONES

You can establish a named fund in memory of loved ones. You can also establish a named fund in honor of loved ones or in honor of a special occassion such as an anniversary, milestone birthday, or bar/bat mitzvah.

What is important to you? What community needs would best honor your loved one or family name and continue that legacy?

Community members have established funds in memory of parents and grandparents or in memory of family members who perished in the holocaust.

YOUTH PHILANTHROPY AND BUILD A TZEDAKAH FUNDS

The Build-a-Tzedakah program allows young adults to engage in charitable giving by contributing $600 from their Bar or Bat Mitzvah gifts, with a match of $400 from a community donor. With this, the young adult now has a $1000 named charitable fund at the Jewish Foundation—they, or others, can add to the fund at anytime and in honor of special occasions- and, every December (Hannukah time), they will be given the opportunity to choose to which charity(ies) they want to make a distribution (distributions are based on the Jewish Foundation’s spending policy but most comply with IRS regulations which inlcludes that they must be charitable and may only be made to US based public charities).

OVER THE PAST TEN YEARS, BUILD A TZEDAKAH FUNDS HAVE DISTRIBUTED OVER $40,000 TO MORE THAN 60 ORGANIZATIONS!

FUNDS FOR THOSE IN NEED

The Maimonides and Devorah Funds at the Jewish Foundation provide anonymous financial assistance for emergencies and/or medical needs.

The purpose of these funds is to help meet immediate needs in the areas of housing, medical care, food, and other emergency relief (coverage of one-time expenses that threaten to put a family or individual in a crisis situation such as inability to pay for childcare and/or transportation that are necessary for income).

These funds were established to follow the precepts of Maimonides, who, in defining levels of tzedakah deemed one of the highest levels to be matan b’seter (giving in secret) in which the benefactor has no knowledge of the recipient and the latter has no knowledge of the individual source of charity.

You can donate directly to the Maimonides and Devorah Funds or establish your own family endowment fund to benefit those in need.

PACE AND LOJE FUNDS FOR THE JEWISH FEDERATION

How can you provide for Jewish education, camps, schools, the frail elderly, those in need, the JCC and for Jews in need abroad and in Israel? By your annual gift to the UJA-Federation of Greater New Haven. And how can you Create a Jewish Legacy to provide for future generations of Jews in Greater New Haven, Israel, and throughout the world? By establishing an endowment for the benefit of the Jewish Federation of Greater New Haven’s Annual Campaign.

Endowments for the benefit of the Jewish Federation’s Annual Campaign are called “PACE” (Perpetual Annual Campaign Endowment) or “LOJE” (Lion of Judah Endowment). A PACE fund is a restricted named fund at the Jewish Foundation which endows your UJA-Federation annual campaign gift. A LOJE fund is a type of PACE fund which provides a permanent endowment to perpetuate a woman’s annual Lion of Judah campaign gift.

PACE and LOJE funds allow our community, through permanent endowment funds dedicated to the Jewish Federation Annual Campaign, to insure that we have funds available that will continue to provide for vital programs and services both in Greater New Haven, in Israel and overseas… for present and future generations.

Ways to Give

Gifts from Your Will

Through a provision in your written and executed will, you can make a gift in the form of cash, securities, real estate or personal property. There are many types of bequests. Choose the one that best fits your needs and intentions.

Beneficiary Gifts

Retirement Accounts

Naming the Jewish Foundation of Greater New Haven as the beneficiary of a qualified retirement plan asset such as a 401(k), 403(b), IRA, Keogh, profit-sharing pension plan or other donor-advised funds, will accomplish a charitable goal while realizing significant tax savings.

Gifts That Pay You

Charitable Gift Annuity

You can turn underperforming assets (stock, cash in a savings account, CDs, savings bonds, etc.) into a gift to the Foundation that provides income to you. Your Charitable Gift Annuity will give you quarterly, fixed payments for life and tax benefits, too.

Gifts of Stock

Appreciated Stock

When you donate appreciated stocks, bonds, or mutual fund shares instead of cash, you'll receive charitable deductions at full, fair market value while reducing capital gains impact.

Charitable IRA Rollover

Charitable IRA Rollover

If you're 70 1/2 or older, you can make a gift directly from your IRA to the Foundation. While there is no charitable deduction for a rollover gift, you do avoid the income tax on the donated portion of your required minimum distribution.

Gifts of Property

Real Estate and Other Valuables

Like stock, the fair market value of gifts of appreciated assets such as real estate, artwork, and other well curated collections, can be deducted from your income tax today and reduce your estate taxes in the future.

Donor Advised Funds

Designate the Foundation to receive all or a portion of the balance of your Donor- Advised Fund (DAF) through your fund administrator (you also can make a grant to us at any time from your donor-advised fund). The balance in your DAF passes to the Foundation when it terminates.

Gifts Through Trusts

Charitable remainder unitrusts make payments to you or another beneficiary with the remaining value passing to the Foundation. Charitable lead trusts provide payments to the Foundation with the remaining value passing to your heirs. For the savvy donor, charitable trusts can provide tax-advantaged income, eliminate capital gains tax, or preserve assets for your heirs.

Gifts OF LIFE INSURANCE

Name the Foundation as the beneficiary of an existing life insurance policy or donate an existing, paid-up life insurance policy you no longer need.

Meet Our Donors

Let’s Start a Conversation

The Jewish Foundation can help you explore charitable opportunities that work for you.

The Jewish Foundation is a trusted and expert resource for charitable gift planning and endowments and serves as a partner and resource for synagogues, local Jewish agencies, professional advisors and donors.

When you make a current gift or leave a bequest to the Jewish Foundation of Greater New Haven, you not only benefit our community, but you can also support the causes that are important to you. You can designate that your gift be used to provide unrestricted funds to help meet community needs now and in the future or to endow a permanent fund to aid identified programs, your synagogue, agencies, organizations, or initiatives (Jewish or not Jewish, in Greater New Haven, Israel or beyond) that are of particular interest to you and your family.

Lisa Stanger, Esq., Executive Director

Tiberius Halai, Grants and Gift Manager

Beth Kupcho, Scholarship and Philanthropy Manager

Stephanie Licsak, Controller

Sarah Domena, Marketing and Communications Director

Tamara Schechter, Create a Jewish Legacy Manager

Jewish Foundation of Greater New Haven

360 Amity Road

Woodbridge, CT 06525

203-387-2424, ext. 382

203-387-1818 (fax)

foundation@jewishnewhaven.org

newhavenjewishfoundation.org

For Professional Advisors

If you are working with a professional advisor or advising a donor, The Jewish Foundation of Greater New Haven is ready to help create a charitable giving strategy tailored to meet your financial and philanthropic objectives. Please consider us your philanthropic resource and partner in helping you to explore charitable opportunities that work for you.