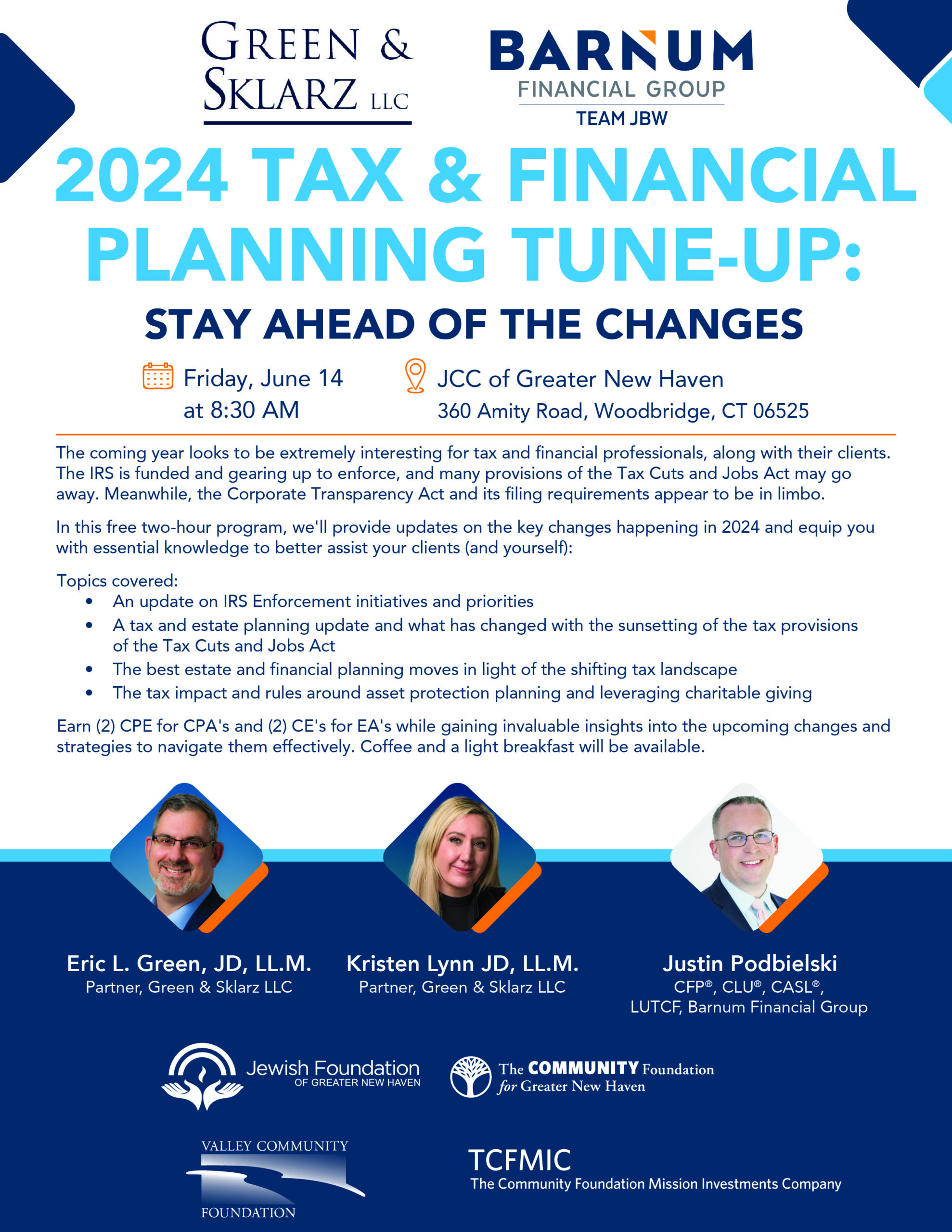

2024 TAX & FINANCIAL PLANNING TUNE-UP:

STAY AHEAD OF THE CHANGES

📅 Friday, June 14 at 8:30 AM

📍 JCC of Greater New Haven

360 Amity Road, Woodbridge, CT 06525

The coming year looks to be extremely interesting for tax and financial professionals, along with their clients. The IRS is funded and gearing up to enforce, and many provisions of the Tax Cuts and Jobs Act may go away. Meanwhile, the Corporate Transparency Act and its filing requirements appear to be in limbo.

In this free two-hour program, we’ll provide updates on the key changes happening in 2024 and equip you with essential knowledge to better assist your clients (and yourself):

Topics covered:

- An update on IRS Enforcement initiatives and priorities

- A tax and estate planning update and what has changed with the sunsetting of the tax provisions of the Tax Cuts and Jobs Act

- The best estate and financial planning moves in light of the shifting tax landscape

- The tax impact and rules around asset protection planning and leveraging charitable giving

Earn (2) CPE for CPA’s and (2) CE’s for EA’s while gaining invaluable insights into the upcoming changes and strategies to navigate them effectively. Coffee and a light breakfast will be available.